Understanding Your Investment Portfolio

When people hear the phrase “investment portfolio,” they often imagine spreadsheets, charts, and a level of financial sophistication they don’t believe they have yet. It sounds technical. Distant. Like something you’ll deal with later.

In reality, most people already have a portfolio. They just haven’t named it.

Your portfolio is the collection of choices you’ve made about where to place value over time. Some of those choices are formal. Others are personal. Together, they reflect how you think about risk, growth, stability, and meaning.

Understanding your investment portfolio isn’t about mastering jargon, but rather recognizing how different assets work together and why balance matters more than optimization. That’s why I’m talking about

What an investment portfolio actually is and why most people already have one

How different assets work together as a system over time

How diversification leads to stability (and it’s not time spent chasing maximum returns)

Where art fits within a well-balanced investment portfolio

How to think about risk, liquidity, and time without overcomplicating decisions

What an Investment Portfolio Actually Is 🤨

An investment portfolio isn’t a list of assets. It’s a system.

Each asset plays a role. Some are designed for growth. Some for stability. Some for access. Some for preservation. What matters isn’t how impressive each individual asset looks on its own, but how they behave together over time.

A well-considered portfolio takes into account time horizon, tolerance for risk, and the reality that life changes. Careers shift. Families grow. Priorities evolve. Portfolios that survive those changes are built with flexibility, not rigidity.

When you understand your portfolio as a system rather than a scoreboard, decision-making becomes calmer and more intentional.

8 Key Principles of a Strong Investment Portfolio ⭐️

If you’re buying original art for the first time, it helps to know what actually matters and what doesn’t. The goal isn’t to memorize rules. It’s to understand how artworks exist, age, and accumulate meaning over time.

1. An Investment Portfolio Is Built as a System, Not a Collection

A strong investment portfolio is designed so assets support one another rather than compete. Each investment serves a purpose within the whole, whether that purpose is growth, stability, income, or preservation. When viewed as a system, decisions are made based on balance and long-term function instead of short-term performance.

2. Diversification Reduces Risk Before It Increases Opportunity

Portfolio diversification is often misunderstood as a way to chase higher returns. In practice, diversification exists to reduce vulnerability. By holding assets that respond differently to economic conditions, a portfolio becomes more resilient and less dependent on any single outcome.

3. Time Horizon Determines the Role of Each Asset

Every investment portfolio is shaped by time. Short-term assets prioritize access and flexibility, while long-term assets benefit from patience and reduced volatility. Understanding how long each asset is intended to be held clarifies where it belongs within the portfolio and how its performance should be evaluated.

4. Value Is Created Through Context, Not Just Price

Price alone does not define the strength of an investment. Context, consistency, and trajectory matter more over time. This applies across asset classes and is especially important when evaluating alternative investments that do not move in sync with financial markets.

5. A Well-Built Portfolio Reflects Both Financial and Personal Priorities

Investment portfolios are not neutral structures. They reflect values, risk tolerance, and lifestyle considerations. Portfolios that align with how people live tend to be sustained longer and managed with greater confidence.

6. Ownership and Engagement Are Part of the Return

Most investments are experienced only through statements and dashboards. Art is different. It exists in your daily life. You live with it, respond to it, and build a relationship with it over time. That engagement is not separate from value. It reinforces long-term holding, discourages reactionary selling, and deepens understanding of why the work matters.

7. Not Every Asset Needs the Same Kind of Liquidity

New investors often assume that all assets should be easily convertible to cash. In reality, portfolios benefit from a mix of liquidity speeds. Some assets exist for access. Others exist for stability and long-term preservation. Art belongs to the latter category. Its slower liquidity encourages patience and aligns with long-term thinking.

8. Starting Small Is Still Starting Intentionally

Portfolios don’t need to be complete to be valid. They evolve. The size of an initial investment matters less than the clarity behind it. Including art early, even at a modest scale, establishes it as part of your financial system rather than an afterthought. Over time, that early inclusion shapes how future decisions are made and how confidently art is held alongside more traditional assets.

Don’t put all your eggs in one basket…

Why Diversification Is About Stability, Not Maximizing Returns 💡

Diversification is often framed as a way to maximize returns. In practice, its more important role is stability.

Different assets respond differently to economic cycles, cultural shifts, and market pressure. When everything you own behaves the same way, your portfolio becomes fragile. When assets move differently, they help balance each other.

Diversification reduces dependence on any single outcome. It allows you to think long-term instead of reacting to short-term fluctuations. This is especially important for people who want their investments to support their lives, not dominate their attention.

Stability creates staying power. Staying power is what allows value to compound over time.

Traditional Assets and Alternative Assets

Most portfolios begin with traditional assets: stocks, bonds, retirement accounts, real estate. These are familiar. They’re widely discussed and easy to track.

Alternative assets enter the picture when investors start thinking beyond correlation and liquidity. These assets don’t always move in sync with financial markets. They often require patience and a longer view.

Tangible assets, in particular, behave differently than paper assets. They occupy physical space. They don’t disappear into abstraction. They’re experienced directly rather than monitored constantly.

That difference matters more than people realize.

Where Art Fits Into an Investment Portfolio 🖼️

Art occupies a distinct position within a portfolio because it operates on multiple levels at once.

Financially, art functions as a non-correlated asset. Its value isn’t tied directly to market indexes or interest rates. It moves according to different forces: cultural relevance, artist trajectory, visibility, and time.

Structurally, art is a long-term holding. It isn’t designed for rapid liquidity. That slower pace can actually strengthen a portfolio by discouraging reactionary decisions and reinforcing a longer horizon.

Personally, art carries meaning alongside value. It’s lived with. It shapes daily experience. It holds emotional and cultural weight in ways that traditional assets do not.

When placed intentionally, art adds resilience to a portfolio. It introduces balance between growth and presence, between abstraction and substance.

Understanding Risk, Liquidity, and Time

Every asset involves trade-offs.

Highly liquid assets offer flexibility but are often more volatile. Less liquid assets require patience but can provide stability and insulation from short-term noise. Neither is inherently better. The key is alignment.

Art is not meant to replace liquid assets. It’s meant to complement them. Its strength lies in its time horizon. When you remove the pressure of immediate resale, you allow value to develop organically.

As life stages change, so should asset mix. Early accumulation looks different than long-term preservation. Understanding where art fits within that timeline helps collectors make confident, grounded decisions.

Building a Portfolio That Reflects Your Values 🌱

Portfolios aren’t neutral—they reflect what you prioritize.

Some people value speed and flexibility. Others value longevity and presence. Many value a balance of both. Art collecting often enters the conversation when people want their investments to feel more connected to how they live.

Values-based portfolios are less about making statements and more about alignment. Owning work you believe in, from artists whose practices you respect, creates coherence between financial decisions and personal identity.

That coherence matters over decades.

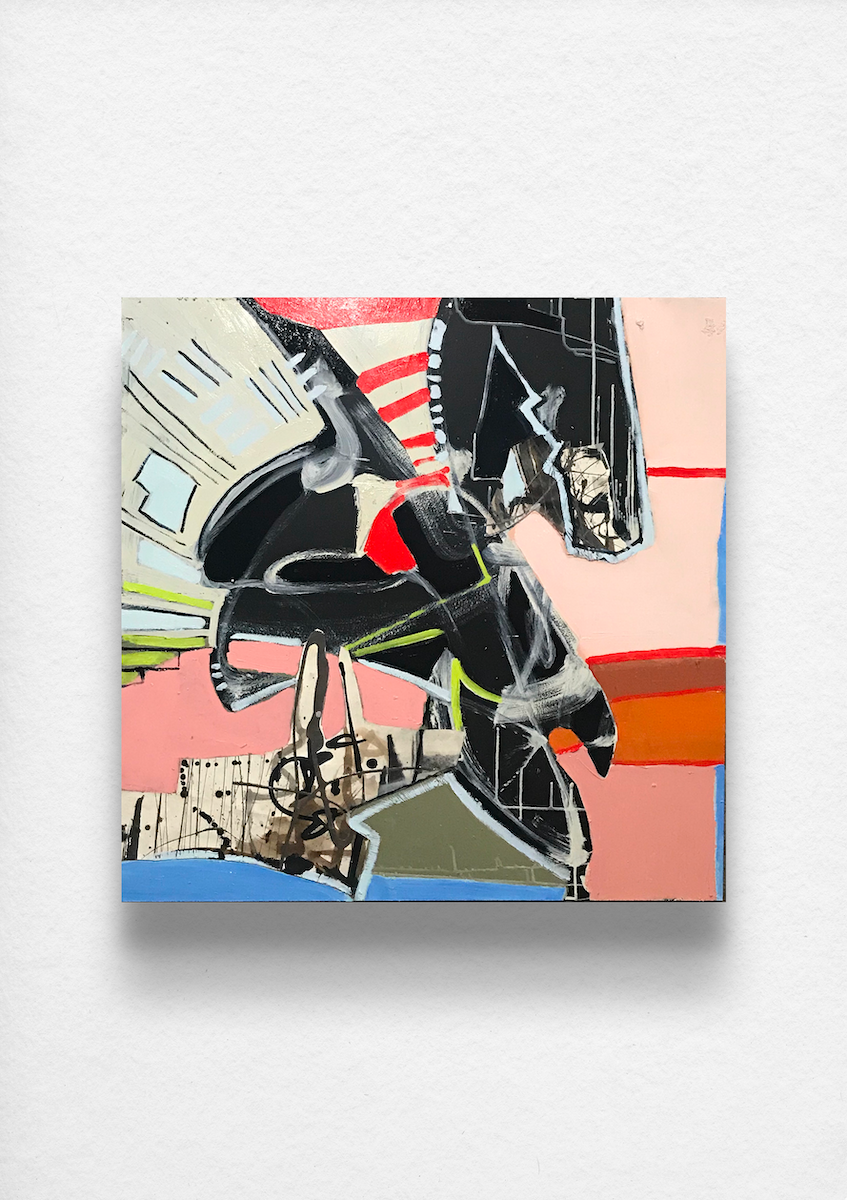

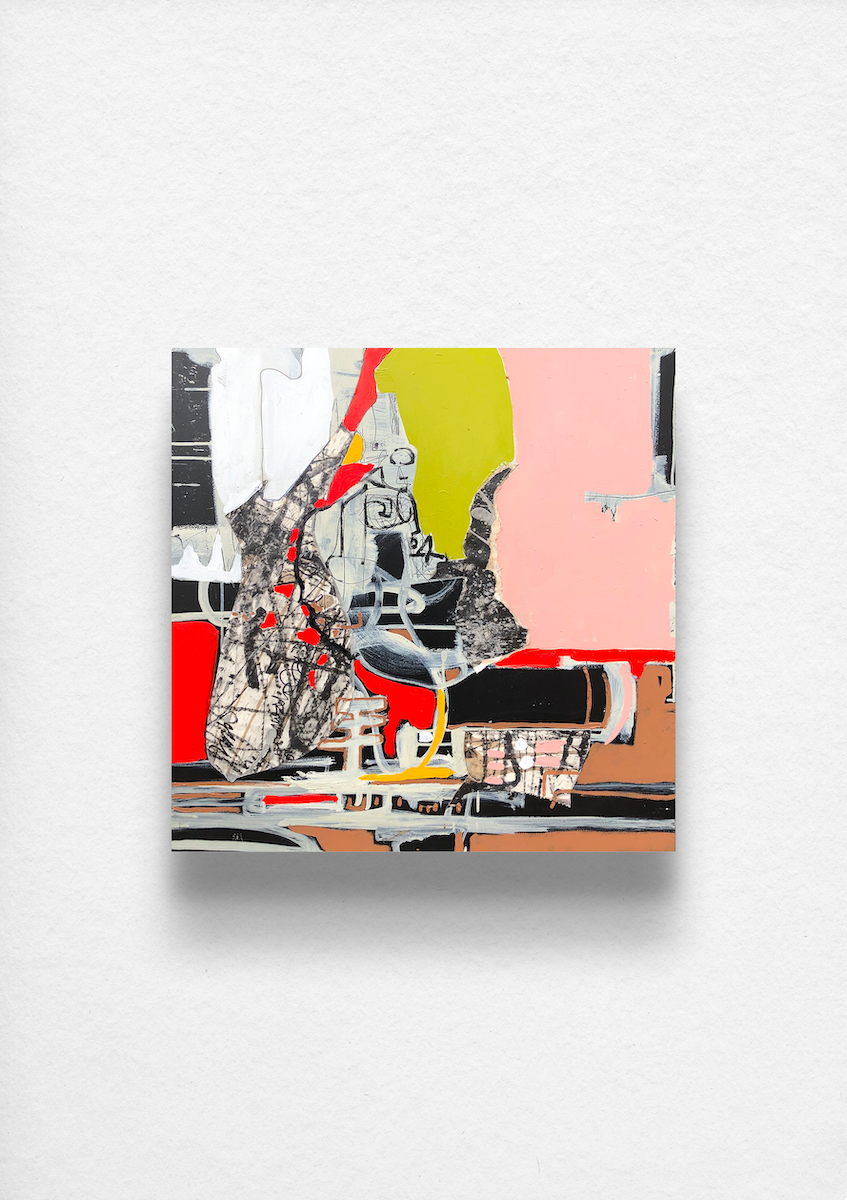

👇🏾 Take a minute to browse through my original artworks to see how they might fit into your growing collection. Every piece is one-of-one, and once it is collected, it is gone.

👉🏾 Or, if you are an artist looking to grow in this city, book a consultation with me. I will help you navigate the scene and build your own legacy.

Art Career Consultations

Whether you’re a student or a seasoned professional, gain personalized guidance from someone who’s navigated the art world firsthand. Learn how to refine your portfolio, secure opportunities, and advance your career with clarity and confidence.

A Portfolio Is Something You Grow Into 📈

Understanding your investment portfolio isn’t a one-time achievement. It’s an evolving process.

As your circumstances change, so will your approach to risk, value, and time. The strongest portfolios adapt without losing structure.

Art belongs in that evolution. Not as an exception, but as part of a broader system that values resilience, meaning, and long-term perspective.

A portfolio is something you grow into, one intentional decision at a time.

Respect,

G

About Gregory

I'm an East Cast native transplanted in the Midwest. I'm namely known as a painter, and have exhibited locally, regionally, nationally, and internationally.

Let’s stay connected: subscribe to my newsletter for insider access and updates!

Mending In Time was built from fragments, repetition, and the act of returning to what isn’t finished. As the exhibition closes on February 27, this chapter asks what it means to collect art during a moment that still feels unresolved — and how collecting becomes participation in something larger than the work itself.